As I pointed out last year, Australia spends more per year on 'defence' than India. India is, of course, the second most populous country in the world, is fighting at least 4 distinct internal guerilla movements, has nuclear weapons, and has two nuclear-armed neighbours (China and Pakistan) with whom it has recently fought border conflicts. Given the importance of technology to modern warfare, military spending tends to be the sole determinant of strategic capability – India has vast, cheap manpower, but Australia has the dollars. Still, just to shore things up, Howard has decided to increase troop numbers massively, by about 5%, although they were already increased by nearly 3% last year to make up a shortfall. Not on a par with India, but this is of course hardly necessary given the type of wars Australia plans to fight, and given that manpower is here much more expensive relative to high-tech armaments.

Brutal pic courtesy of SMH

Howard claims that the increase is needed because of 'instability in the region', 'the region' being the South Pacific. Certainly, Australia's military is overstretched. It is part of the occupying forces of two large countries, Afghanistan and Iraq, and single-handedly commited to holding down some smaller countries, like the Solomon Islands and Timor Leste. Australia was recently making noises about being part of a Israeli-proxy UN occupation force in Lebanon. To this end not only is the army being expanded, but a police force for deployment overseas – which is to say, a dedicated occupation force – is being massively increased by 1,000 personnel.

This is being sold as an exercise in humanitarianism, as Australia being a responsible regional superpower. This is nothing short of complete nonsense. For one thing, a significant portion of Australia's deployments are not in its region at all, but in the Middle East, in support of naked American imperialism. For another thing, there is, of course, no humanitarian motive behind Australia's 'regional' deployments. Howard's bold prediction that there will be an increased need for troops in the region appears as an assertion of what all Aussies know, that the local frizzy-haired populations are in fact degenerating in their ability to govern themselves, necessitating direct intervention in their savage affairs. Of course, the reality is that Australia's interventions in the region are imperialist assaults on the sovereignty of indigenous populations, aimed not at helping them, but at protecting Australian commercial interests, primarily in the natural-resources-theft industry. Howard's prediction indicates two things: firstly, a prediction of growing resistance regionally to Australian imperialism, and, secondly, a desire for Australia to amp up the level of corporate super-exploitation of the region, something that can only occur with Australian guns to back it.

25 Aug 2006

Australian militarism: arming for imperialism

23 Aug 2006

Australia's judicial 'disproportionate response'

Gotta love the Gitmo-style orange jumpsuit.

For three charges, Faheem Khalid Lodhi has been sentenced to twenty years in prison (quotes from SMH article):

This evidence convinces me that Lodhi was thinking about bombing the electricity supply system. It convinces me neither that he was going to bomb the electricity supply system, nor that he was even thinking about killing anyone. Really, he has been convicted not of acts but of being a 'terrorist', on the basis of a discernible essence, which has been determined via the equation Muslim + beard + terror manuals.

It is the new Dranconian laws that are to blame. Under Australia's old laws, the authorities could have surveilled the guy and waited to see if he did anything, like actually acquiring the chemicals, or making them into explosives, or trying to use these explosives. Making inquiries about buying knives while also possessing a handwritten manual about how to cut people up, and the address of someone you have cause to want to stab is not tantamount to attempted murder.

See also my post about his conviction two months back.

22 Aug 2006

It's the Apocalypse

Or at least, Sydney's version thereof, which can be summed up in two words:

negative equity

Seriously, this is a nightmare: as interest rates rise and unemployment increases – how could it not from an historic low? – not to mention that the construction industry, which employs 10% of working Sydneysiders, is being grossly undermined – the poorest decile of home-buyers, those who are the ones hit by rising unemployment and the same ones with negative equity, will be expropriated. It's good news for solvent investors, however, who can snap up fire sale properties and then rent them out to newly homeless families, which, as I understand it, is what is happening with the brick veneer pile pictured above.

21 Aug 2006

The new line on David Hicks

As I noted the other day, there seems to have been a change in Australian government policy towards the case of the illegally-detained Australian Muslim, David Hicks. Here it is again, except that Darth Ruddock has moved even further towards a pro-Hicks position. He's basically said that the government (i.e. his master, Darth Howard) are not happy about Hicks being kept in infinite detention. There is some logic to this. They were quite happy to see Hicks face a kangaroo court, but now that the court has been declared illegal, they're not happy for him to continue being detained. It's a bit bizarre to claim that they are unhappy with indefinite detention, but they were happy with a long detention followed by a dodgy and illegal trial, but presumably they think the US Supreme Court are a bunch of liberal wimps who are interfering with justice.

OK, so the new line is that they don't like Hicks being in detention, but there's nothing much they can do about it. This seems to grossly contradict Ruddock's previous attempt to claim credit for getting the US's other Australian in Guantanamo freed; in fact, just a week ago, Ruddock was claiming that if the US didn't put Hicks on some kind of ludicrous trial, "we would be seeking his return in the same way we did with Mamdouh Habib".

One suspects that Ruddock et al. have now approached the US administration and been rebuffed, hence this new 'we are impotent' line (to be used also to explain economic conditions, and any other negative phenomena which may arise). Regardless of whether he has tried to do anything, I don't really doubt that Ruddock is right about there not being anything much he can do in this regard. Australia is America's servant, and does not have any real power in its relationship with its imperial master – and cna grovel for favours, but the US will only grant them if it feels like it. Which means that Habib was freed because, even after the Egyptians had totrued him, they didn't find enough evidence to try him in front of even a kanagaroo court.

Rich get richer

Source:SMH article

Source:SMH article

I don't have anything definite to add to the article, so what follows is really speculative.

A tantalising comment in the SMH article is that is that the massive growth in executive incomes is skewing the whole picture of earnings. Which makes me wonder whether this enormous growth is not a major driver of the inflation which is resulting in the flagellation of the indebted masses.

19 Aug 2006

Jack Thomas is free!

Jack Thomas, convicted of and imprisoned for receiving money from terrorists, has been freed. As I pointed out when he was convicted, the fact that what he did – take money from terrorists, but without there being any evidence he did so for any other reason than to escape to Australia – is illegal is ridiculous. He's now got off on what is a very reasonable legal technicality, that the way his confession of his actions was extraced, viz. through threats, torture and inducements, rendered it invalid.

Read Jeff Sparrow's write-up on LeftWrites.The first commenters does, however, point out that this appeal decision may itself be appealed, so Jack is not out of the woods yet.

18 Aug 2006

Australian Citizenship

I've lived in Australia for four-and-a-half years, but I'm not an Australian citizen, or even a 'permanent resident', the necessary pre-requisite to becoming a citizen. You have to be a permanent resident residing in Australia for a minimum of two years in the previous five, of which one year has to be concurrent with your application, to get Australian citizenship. If you can't stay in the country concurrently for 12 months, you'll never become an Australian citizen.

For most purposes, permanent residency suffices. It gives you most of the employment and legal rights citizens enjoy, and the same welfare benefits. University scholarship are generally available to permanent residents as to citizens. Permanent residents can become policemen (at least in NSW).

There are some rights you are not accorded, however. These include political rights, such as the right to vote (which in Australia is also a legal obligation), or to run for office. You also cannot work in the Australian federal public service, what's known in British English as the "civil service". You can kind of understand why this would apply to DFAT (Department of Foreign Affairs and Trade) with its overseas postings (permanent residents lose their PR if they go overseas for more than five years continuously – it would be pretty perverse for people to lose that right because they were representing the Australian government), but why on earth can't non-Australians work in the Australian Tax Office, for example? Are they inherently untrustworthy?

The answer, of course, is that Australia is a club, and non-members don't get the benefits. This is essentially racism. Not of the narrow type that discriminates on the basis of skin-colour, although there is an element of that here. Rather that which defines people according to a racial essence and discriminates accordingly. IF I sound bitter you'd be right – although, I must admit that I enjoy less tangible advantages from Australian racism, being whtie and English-speaking.

At the Eureka Stockade, long prior to the existence of Australian citizenship, those mostly-immigrant rebels adopted a thoroughly petty bourgeois, but nevertheless basic and reasonable slogan: No Taxation Without Representation. You can't take our money if you don't give us a say how it's spent. As non-Australian residents (I mean 'resident' for tax purposes – I reckon there's at least 2 million of us, over 10% of the population), we are in this country, paying taxes to support politicians and bureaucrats, whose jobs we are not allowed to access. Australian citizens overseas (of whom there are around a million), however, without paying taxes are legally obliged to give their opinion about how the money I pay to the government is to be spent.

Of course, I'd rather raise a more democratic slogan: No Government But By The Governed. It's not the taxes that essentially give me the right to demand a say in how Australia is run, but the fact that I am bound by Australian law. It is therefore in my interests, not in those of Australians who do not live here, how this government operates. I do not propose this as an idea for reform; I propose it as an unconditional demand by one governed to those who govern me, bureaucrats and politicians alike.

Appendix: Just happened to read an article about the Tampa refugees: about 10% of them, 28 people, are still in Australia. A cruel irony is that while these were ones clearly identified as refugees who the Australian government could not send back, they are kept in a limbo of temporary visas, unlike many of those shipped off to other countries with more humane migration regimes. Only 2 of the 28, five years after arriving in Australia, have Australian citizenship, and three more permanent residency – in all these cases, this is becuase they qualified for schemes like those to attract skilled labour to rural areas, not through their need as refugees. The other 23 therefore have no permanent status in this country and cannot bring over their spouses and children.

15 Aug 2006

Coalition ducks and weaves

In one day, we have three sudden jerky movements by the federal government.

Firstly, they dropped their plan to make immigration law yet more draconian. There's no secret about why this happened: they were staring defeat in the senate in the fact, since their own senators could not be relied upon. This is basically a Good Thing, as far as I can see.

Then, Darth Ruddock announces that they may seek to have David Hicks repatriated if the US don't charge him with anything (their previous attempt to charge him with something in a specially-convened kangaroo court having been declared unconstitutional). This is, it seems to me, a really significant u-turn by a government that has tried to completely disown Hicks for the last four+ years. Ruddock also seems to be claiming credit for the American release of Mamdouh Habib, Australia's other Guantanamo detainee now. This move is clearly, like the previous one, not about winning votes. Right-wing populism with its total disdain for the other – migrants, Muslims – is what this government's electoral success is built on. Rather, both moves are about the fact that certain very influential people – Liberal MPs, high-profile lawyers – are vociferously unhappy with the government's disregard for human rights/decency.

Thirdly, something much more transparent: the subsidy to convert cars to Liquefied Petroleum Gas. Kind of a weird one. The obvious placatory measure would be to subsidise petrol. But of course that would mean implicitly admiting that the government can do something about petrol prices, rather than allowing the 'market' to determine the price. Weirdly, it's OK to leverage the market left, right and centre to get alternatives to petrol happening. There's a twisted logic here, and it does make the government look progressive. Not enough to get progressives voting for them, but enough to get their own voters to justify to themselves keeping their heads burried in the sand.

The big issues are untouchable though. The government cannot backtrack on industrial relations, and it cannot influence interest rates. Which is to say, it has the capacity to do these things, but is not about to use it. And these, it seems, are the issues around which the next election will be won or lost. Well those, and the mass-delusional politics of trust, confidence and personalities.

7 Aug 2006

The Wizard of Oz

John Howard set himself up as a sitting duck when he, er, implied that interest rates would stay down if the Coalition was re-elected in 2004. It’s hard to see that manoeuvre as anything other than short-termism, since he can’t have been so stupid as to believe it, and must have known it would backfire sooner or later. But he’s right now that the government is not really to blame or credit for what happens to interest rates, and he was wrong then.

So should we blame the Reserve Bank? The short answer: not really. Monetary policy moves within limits set by economic forces, and focusing criticism on the Reserve Bank rather than those forces is shooting the messenger.

Cyclones and bananas are a red herring. Ross Gittins is right on that. It’s true that the headline inflation rate would have been a lot lower without them and fuel, but the Bank board was well aware of that, and Governor MacFarlane says the Board ‘abstracted’ from those outliers. It is normal practice for monetary policymakers to focus on the underlying rate, which excludes volatile prices.

MacFarlane’s statement is clear: the Board blames the underlying inflation rate on high demand caused by two factors: 1) an international boom, which has driven up commodity prices and boosted Australian incomes; and 2) high domestic demand fuelled by borrowing. The Bank can do nothing about the first, so the burden is placed on domestic borrowing, with mortgagees suffering the most.[1]

Cost enters the equation from the other side. MacFarlane talks of “the background of an economy operating with limited spare capacity”. Raw materials prices are well up, especially commodity prices, which is a global phenomenon. More importantly, “labour market conditions are tight.” That’s the typically oblique way of saying that the economy faces the danger of stronger worker bargaining power – especially over wages, but any worker control that undermines productivity is bad news on the inflation front.

So the Reserve Bank board looks ripe for demonisation. But of course the Bank is doing exactly what it’s supposed to be doing. The central bank has evolved with capitalism as a kind of brake, to deal with its inherent instability. If the brake is not applied, it doesn’t mean smooth, fast riding forever, it means spinning out of control and maybe a crash.

It is an open secret that capitalism needs a large pool of unemployment to function properly, so that labour can flow freely into new projects and to keep pressure off wages. For a quarter-century after World War II it looked like relatively full employment would be sustainable, but even then many businesspeople and economists pined for the old ways. The revolution in monetary policy since the stagflationary crisis of the 1970s was partly about how economic policymakers stopped worrying and learned to love unemployment.

Central banks around the world have been made ‘independent’ – i.e., technocracies beyond democratic control – because politicians could not be trusted to risk unpopularity by turning on the brake. Now central banks take the heat, but then criticism sputters out because all the major players accept the rules of the game. The electoral politics of money has been reduced to the question of which side’s policies would make the Bank more likely to put up interest rates.

Often central bankers play into the mythology about their place in the world, in which they are philosopher-kings with hands on all the economy’s levers, gracefully guiding a complex system whose ken is beyond mortals. At a charity lunch last month, Glenn Stevens, heir to the governors’ chair, casually boasted about what the Bank does:A large data set is monitored – a couple of thousand domestic and international data series are routinely tracked, including all the major ABS statistical releases, and at last count 16 privately compiled Australian business surveys…. The staff in our regional offices have built up a pool of over 1,500 regular contacts around the country, and visit about 100 of them every month. On the basis of those visits, they compile a comprehensive picture of trends in demand, output, labour markets, costs and prices. This is used alongside the standard economic time series in forming our assessment of the economy.

But for what? All those statistics, and all the Board can do is put the cash rate up or down slightly, once a month. Often, reading their statements, you realise that they don’t actually feel all that powerful. In the same speech, Stevens said that he was surprised that the media focused so much on domestic factors when analysing Bank moves, when clearly the board pays a lot of attention to overseas factors. That was certainly true this time around, despite the fact that the official statement began, as usual, with trends in the world economy. The Bank’s quarterly Statements on Monetary Policy generally only start talking about domestic conditions after 15 pages on the international situation.

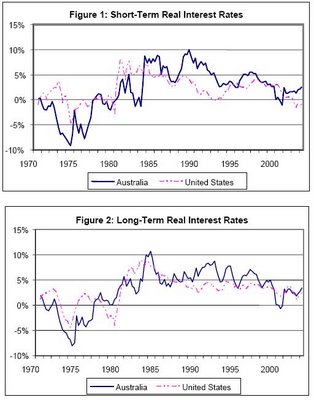

Furthermore, since capital is mobile, Australian interest rates only have a limited autonomy from rates elsewhere. Stevens is at pains to show that there is some autonomy, but the evidence is pretty clear that real interest rates here, especially long-term rates, stay close to American rates. Check out the graphs from Ernst Jeurg Weber’s article in the June 2005 issue of the Journal of Australian Political Economy.

Finally, the Bank controls only the cash rate, the rate on money lent overnight between banks. Generally other rates follow it, but they’re set by the private banks and in the bond markets. Central banks lead the market, but don’t control it, and can’t stray too far. Lately some central banks have found their tightening foiled by private banks not following their lead. The Reserve Bank of New Zealand has been complaining that the banks there have not been raising mortgage rates along with the cash rate, because of competition in the mortgage market and the availability of funds from overseas. Here in Australia this time mortgage rates rose with the cash rate, but the Bank’s official statement complains that over the last few years the private banks’ lending margins (between interest they pay and what they lend at) have compressed so that lending rates

So, while monetary policy and the undemocratic Reserve Bank should certainly be criticised, we have to realise that its control is limited. Capital’s power is much more diffuse, and interest rates are only a symptom with much deeper causes. This is my thesis topic and no doubt I’ll be posting plenty more.

[1] This is a relatively new development – textbooks will tell you that monetary policy works mostly through business investment, but as household debt mounts, it works increasingly directly on consumer spending by squeezing the incomes of working class borrowers.

2 Aug 2006

Today's Interest Rate Rise

Like the vast majority of people I feel like I'm not entitled to speak on matters of interest rate policy, that I don't understand what's going on. I thought everyone had gone insane, but was hopeful that I might be missing something. Until I read what Evan Jones, a professional political economist posted on the subject, which essentially confirmed that I was right.

This is the argument that is being presented for the new interest rate hike: the value of petrol has gone up, therefore the value of many commodities (which are either partly made from or at least transported through burning petrol) have gone up. Therefore there is 'inflationary' pressure on prices.

So far so good. This pressure will likely make wages go up, since people need the money from their employment to pay for the increasing prices. So we see the beginnings of an inflationary spiral.

It's quite clear that there is only one mechanism which is employed in the neo-liberal order to control inflation. That is the 'interest rate', which the supposedly-politically-independent put up every time inflation rises, and are consequently called geniuses by the news media.

The rationale for this is very clearly that it is spending which causes, or at least exacerbates inflation, and raising interest rates makes loans more expensive and saving more attractive, hence discourages consumer spending.

However, this will not change the underlying cost of commodities. What it in fact does is increase the cost of living for the large proportion of the population who are in debt and thus puts pressure on wages. As Jones says, this in fact exacerbates inflation. While demand for commodities will fall in that fewer people can afford to pay for them, this is simply to fomet economic disaster, since it will simply render businesses unviable. It heralds a deflationary race to the bottom, of falling wages and destitution as the wages we have give us less and less spending power in an economy afflicted with high commodity price inflation.

Well, that's my two cents. Political economist readers are sure to chime in. Obviously, this is not the end of the Australian economy per se yet, since so much of it is based on primary production for export. Urban economies like Sydeny's however, especially the urban working class who are engaged in industries of secondary and tertiary production and who have high levels of consumer debt, are in for a rough ride.

Racial Vilification

In Western Australia in 2005, they brought in a law against racial vilification. They did this in response to a spate of racist graffiti in Perth.

I'm fairly sympathetic to the idea that a law might be needed here. Racist graffiti is clearly worse than street art, which generally, probably shouldn't be illegal at all.

The first actual application of the new law is in fact however itself racist. Some black girls who allegedly verballed a white girl in Kalgoorlie in racist terms are being charged with it. I won't trivialise the incident itself, because it seems to have been a shockingly brutal assault, of a type which women I know in Sydney have also experienced at the hands and feet of teenage black girls. None of this changes the fact, however, that white people cannot in fact be vilified racially. You can try it, but it just doesn't work.

A case in point, on a Friday or Saturday night I was in the Glebe side of Parramatta road with a friend and this young Leb guy started heckling us from the passenger side of a car stopped in traffic, calling us 'Irish bastards', or 'cunts', or something along those lines. I take it that he was doing a delicious parody of the way in which he, an Australian, is always referred to as 'Lebanese', despite the fact that he is quite possibly from an Iraqi background anyway, etc. The thing is, that if he was trying to racially vilify us, it didn't work, in that calling us Irish will not make us as alienated as calling him a Leb would. I was just worried he wanted to fight us. And if he had done, it would have undoubtedly been partly as a result of a lifetime of racial vilification. I take the same view about Bilal Skaf, scumbag though he undoubtedly is.

The Kalgoorlie is a perfect example of the post-Apartheid mentality in Australia: from the oppression of blacks by treating them unequally, to the oppression via formal equality, by applying the same standards to people who've had everything stolen from them. The Australian right is oblivious to how farcical it is to steal everything someone has, so that you are rich, and then urge them to work to get back a fraction of what they once had. The incident is also highly indicative of a general oppression of black people, and the working class more generally, on the basis of the punishment of people's inability to particpate properly in the right linguistic games. John Howard can be as racist as he likes, as long as he doesn't call anyone a 'boong' or a 'chong'.