John Howard set himself up as a sitting duck when he, er, implied that interest rates would stay down if the Coalition was re-elected in 2004. It’s hard to see that manoeuvre as anything other than short-termism, since he can’t have been so stupid as to believe it, and must have known it would backfire sooner or later. But he’s right now that the government is not really to blame or credit for what happens to interest rates, and he was wrong then.

So should we blame the Reserve Bank? The short answer: not really. Monetary policy moves within limits set by economic forces, and focusing criticism on the Reserve Bank rather than those forces is shooting the messenger.

Cyclones and bananas are a red herring. Ross Gittins is right on that. It’s true that the headline inflation rate would have been a lot lower without them and fuel, but the Bank board was well aware of that, and Governor MacFarlane says the Board ‘abstracted’ from those outliers. It is normal practice for monetary policymakers to focus on the underlying rate, which excludes volatile prices.

MacFarlane’s statement is clear: the Board blames the underlying inflation rate on high demand caused by two factors: 1) an international boom, which has driven up commodity prices and boosted Australian incomes; and 2) high domestic demand fuelled by borrowing. The Bank can do nothing about the first, so the burden is placed on domestic borrowing, with mortgagees suffering the most.[1]

Cost enters the equation from the other side. MacFarlane talks of “the background of an economy operating with limited spare capacity”. Raw materials prices are well up, especially commodity prices, which is a global phenomenon. More importantly, “labour market conditions are tight.” That’s the typically oblique way of saying that the economy faces the danger of stronger worker bargaining power – especially over wages, but any worker control that undermines productivity is bad news on the inflation front.

So the Reserve Bank board looks ripe for demonisation. But of course the Bank is doing exactly what it’s supposed to be doing. The central bank has evolved with capitalism as a kind of brake, to deal with its inherent instability. If the brake is not applied, it doesn’t mean smooth, fast riding forever, it means spinning out of control and maybe a crash.

It is an open secret that capitalism needs a large pool of unemployment to function properly, so that labour can flow freely into new projects and to keep pressure off wages. For a quarter-century after World War II it looked like relatively full employment would be sustainable, but even then many businesspeople and economists pined for the old ways. The revolution in monetary policy since the stagflationary crisis of the 1970s was partly about how economic policymakers stopped worrying and learned to love unemployment.

Central banks around the world have been made ‘independent’ – i.e., technocracies beyond democratic control – because politicians could not be trusted to risk unpopularity by turning on the brake. Now central banks take the heat, but then criticism sputters out because all the major players accept the rules of the game. The electoral politics of money has been reduced to the question of which side’s policies would make the Bank more likely to put up interest rates.

Often central bankers play into the mythology about their place in the world, in which they are philosopher-kings with hands on all the economy’s levers, gracefully guiding a complex system whose ken is beyond mortals. At a charity lunch last month, Glenn Stevens, heir to the governors’ chair, casually boasted about what the Bank does:A large data set is monitored – a couple of thousand domestic and international data series are routinely tracked, including all the major ABS statistical releases, and at last count 16 privately compiled Australian business surveys…. The staff in our regional offices have built up a pool of over 1,500 regular contacts around the country, and visit about 100 of them every month. On the basis of those visits, they compile a comprehensive picture of trends in demand, output, labour markets, costs and prices. This is used alongside the standard economic time series in forming our assessment of the economy.

But for what? All those statistics, and all the Board can do is put the cash rate up or down slightly, once a month. Often, reading their statements, you realise that they don’t actually feel all that powerful. In the same speech, Stevens said that he was surprised that the media focused so much on domestic factors when analysing Bank moves, when clearly the board pays a lot of attention to overseas factors. That was certainly true this time around, despite the fact that the official statement began, as usual, with trends in the world economy. The Bank’s quarterly Statements on Monetary Policy generally only start talking about domestic conditions after 15 pages on the international situation.

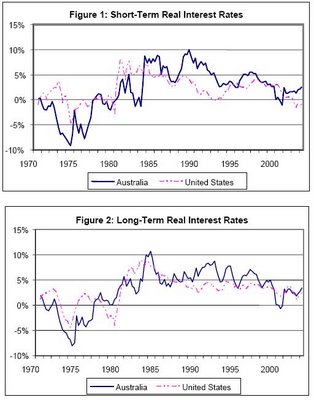

Furthermore, since capital is mobile, Australian interest rates only have a limited autonomy from rates elsewhere. Stevens is at pains to show that there is some autonomy, but the evidence is pretty clear that real interest rates here, especially long-term rates, stay close to American rates. Check out the graphs from Ernst Jeurg Weber’s article in the June 2005 issue of the Journal of Australian Political Economy.

Finally, the Bank controls only the cash rate, the rate on money lent overnight between banks. Generally other rates follow it, but they’re set by the private banks and in the bond markets. Central banks lead the market, but don’t control it, and can’t stray too far. Lately some central banks have found their tightening foiled by private banks not following their lead. The Reserve Bank of New Zealand has been complaining that the banks there have not been raising mortgage rates along with the cash rate, because of competition in the mortgage market and the availability of funds from overseas. Here in Australia this time mortgage rates rose with the cash rate, but the Bank’s official statement complains that over the last few years the private banks’ lending margins (between interest they pay and what they lend at) have compressed so that lending rates

So, while monetary policy and the undemocratic Reserve Bank should certainly be criticised, we have to realise that its control is limited. Capital’s power is much more diffuse, and interest rates are only a symptom with much deeper causes. This is my thesis topic and no doubt I’ll be posting plenty more.

[1] This is a relatively new development – textbooks will tell you that monetary policy works mostly through business investment, but as household debt mounts, it works increasingly directly on consumer spending by squeezing the incomes of working class borrowers.